For the past 4 to 5 months, many home buyers in Houston, and across the country, have been in a wait-and-see mode. They have been waiting and seeing if either home prices come down or mortgage rates fall, but preferably they’d love both. After 3 years of rising home prices and multiple offer stampedes in most Houston neighborhoods, you can understand why many are looking for a more Buyer friendly market.

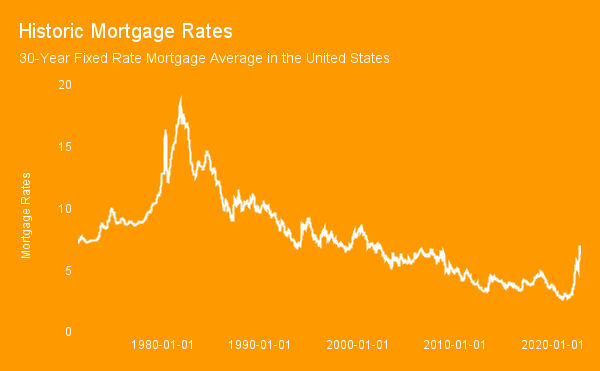

Buyers might well be in luck on the mortgage rate front. Inflation has been driving rising mortgage rates since the Spring. After hitting the highest inflation rate in 40 years back in June, we are finally starting to see some signs that inflation might be easing. The Consumer Price Index (CPI), a key measure of inflation, has been coming in better than expected for the past 2 months. As a result, mortgage rates have fallen to their lowest level in several months. Although it is not expected that rates will fall back down to pandemic levels, or even the immediate period pre-pandemic, mortgage rates falling below 6% will be a welcome development for many home buyers. It would also be a level that is pretty attractive historically.

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, December 14, 2022.

After the market checks that box for prospective homebuyers, what about home prices? Are home prices going to come down in Houston? That is going to be very dependent on whether inventory levels in Houston rise or not. Although we have seen a modest increase in housing inventory in most Houston neighborhoods, inventory in general is historically low. Unlike many housing slowdowns, the one we have been experiencing is not driven by or coupled with a slowing Houston economy. According to the most recent data, the Houston economy is doing pretty well. As a result, most homeowners haven’t been forced to sell. Like first time homebuyers, they have been in wait-and-see mode. So even as homebuyer demand has fallen, the number of available homes is still relatively low. Although we have certainly moved closer to a buyer’s market, we aren’t all the way there. The market is now relatively balanced but closer to a seller’s market than a buyer’s.

2023 Outlook

So what does that all mean for 2023? Well, if mortgage rates continue to fall, or remain stable, we will probably see some pent-up demand enter the 1st quarter of this year and then possibly accelerate (as it typically does) in the Spring. As a result, and assuming the local economy remains resilient, we are probably going to see home prices continue to rise in 2023. However, this will probably be at a much slower rate than what we saw over the past 2 years.

Bottom Line: Whether 2023 is the right time to buy or sell for you, will ultimately depend on 1) the neighborhood you want to buy or sell in, 2) the long-term goals for you or your family, and 3) how affordable the homes you want to buy are for you at current rates or prices. Trying to time the market can be tricky. Rising prices can have a much bigger impact on the long-term cost of housing than mortgage rates. Do your due diligence, focus on the long-term, and find a good local advisor.

As local market experts, we are well placed to guide you through the issues most likely to impact sales and home values in most Houston neighborhoods. If you’re considering buying or selling a home in 2023, contact us now to schedule a free consultation. We’ll work with you to develop an action plan to meet your real estate goals this year. Fill out the form below to get matched with an agent to learn more about the home buying and home selling process.

GET MATCHED WITH AN AGENT