Although the Houston Real Estate market has experienced a decline from the pandemic years, it is important to put the current situation into perspective. Although March 2023 saw a decline year-over-year, a comparison to the last “normal” year, 2019, shows a different picture. In comparison to historical standards, the Houston Real Estate market is performing well, although not as exceptionally as in the past 2 years. In this month’s report, we’ll sprinkle in some 2019 numbers to provide better context.

According to the latest report from the Houston Association of Realtors (HAR), single-family home sales fell 18.3 percent year-over-year, with 7,907 units sold. When compared to March of 2019, when sales volume totaled 6,995 units, sales are actually up 13.0 percent.

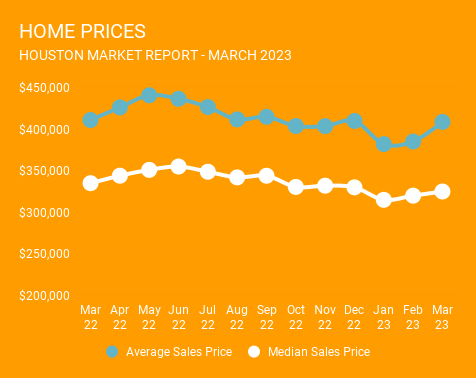

March 2023 home prices dropped year over year when compared to March 2022. The median price dropped 3.0 percent to $325,000 while the average price was statistically flat at $408,647. That being said, month-over-month prices have been rebounding since January lows.

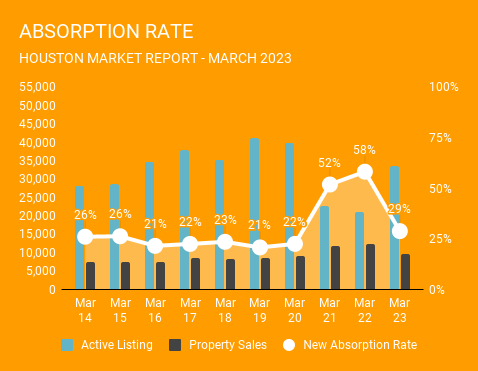

According to HAR, total active listings, or the total number of available properties, increased 69.2 percent to 33,442. March sales of all property types totaled 9,589 down 20.9 percent compared to March 2022. As a result, the absorption rate for March 2023 was 29 percent. This is the highest absorption rate we have seen since August 2022. For home sellers, this is good news. Higher absorption rates make it much more likely that home prices will remain stable or move higher in most areas of Houston.

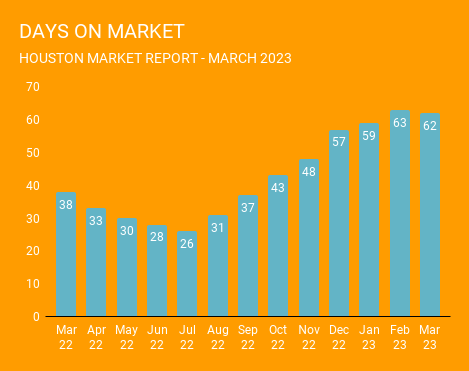

The Days on Market (DOM), or the number of days it took the average home to sell, rose to 62 days in March, up from the 38 days on market we saw last March, but slightly lower than last month.

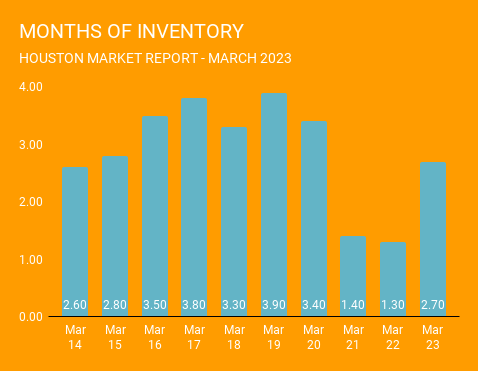

Inventory levels rose again in March, reaching a 2.7-months supply. That is the highest level since July 2020. Housing inventory nationally stands at a 2.6-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply is widely regarded as a “balanced market” in which neither the buyer nor the seller has an advantage.

In the past few weeks, mortgage rates have been fluctuating but have not strayed too far from a consistent range. As we approach the peak of the Spring homebuying season, we are likely to see some positive real estate numbers. We expect that homes will continue to sell relatively quickly and that home prices will either remain stable or increase.

Whether the market is booming or slow, be prepared. Make sure you have the information you need to make an informed decision on when to start house hunting or listing your home. Contacting a Norhill Realtor is a good place to start. Get connected with one of our experienced agents who can talk you through the market in the neighborhoods you care about as well as discuss the timing for either selling or buying.

GET MATCHED WITH AN AGENT

Find and click your neighborhood below to find the latest listings and local market data for these great Houston neighborhoods. |

|

| Afton Oaks / Highland Village Bellaire Briargrove Briargrove Park / Walnut Bend Brooke Smith Camp Logan / Glen Cove Cottage Grove Downtown EADO / Eastwood Sawyer Heights / First Ward Art District Garden Oaks Houston Heights Knollwood / Woodside Memorial West Meyerland Area |

Midtown Montrose Oak Forest Mangum Manor / Oak Forest West Rice Military / Washington Corridor River Oaks Shopping Area Shady Acres Shepherd Plaza Park Spring Branch Spring Valley Timbergrove / Lazybrook University Place / Museum Park Westbury / Maplewood / Brays Oaks West University / Southside Willow Meadows / Willowbend |