May 2024 brought unexpected challenges and resilient performance to the Houston real estate market. Despite severe weather and disruptions, the market saw robust activity, with inventory reaching the highest levels since before the pandemic, signaling a shift towards a more balance between buyers and sellers.

Key Highlights from the Houston Association of Realtors (HAR) May 2024 Market Update:

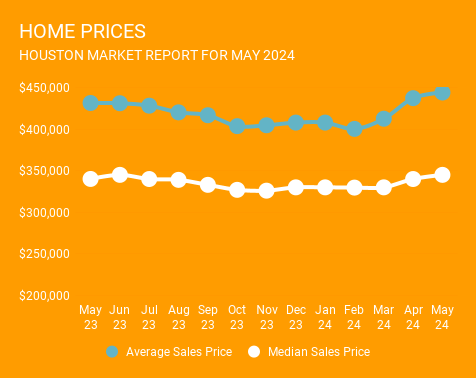

Home Pricing: The average price of single-family homes reached a new record of $443,970, surpassing the previous record set in May 2022. The median price also rose to $345,000, up 1.5% year-over-year.

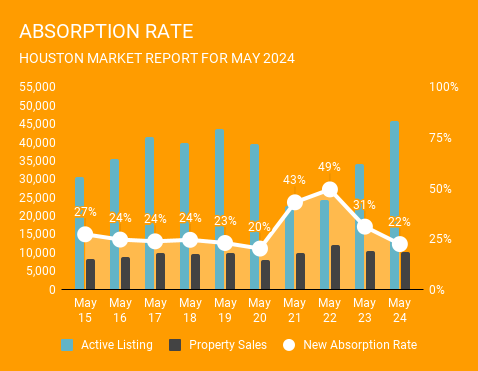

Likely to Sell: According to HAR, total active listings, or the total number of available properties, increased 32.3 percent to 43,044. April sales of all property types totaled 9,611 up 8.7 percent compared to April 2023. As a result, the absorption rate, which is a measure of any given home’s likelihood to sell, for April 2024 was 22 percent. This is back in line with the very normal absorption level pre-pandemic. At these levels, prices tend to move up moderately, but buyers still have choices and time to shop around.

Luxury Market: The luxury market led property sales with a 9.6% increase for homes over $1 million. The next best performing segment was homes priced between $500,000 and $1 million, which saw a 6.8% rise. Sales in all other price ranges slowed.

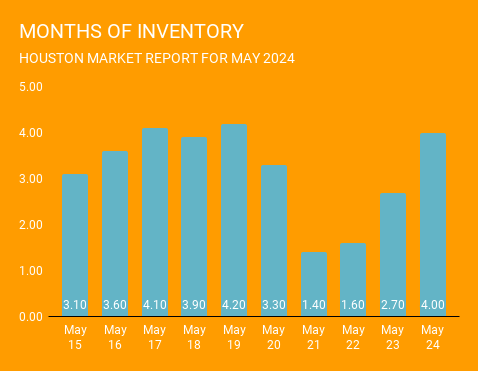

Inventory: The Houston home supply increased to a 4.0 -month inventory, the highest since October 2019, returning to pre-pandemic norms similar to the absorption rate. According to the National Association of Realtors (NAR), the national inventory stands at 3.2 months. A supply of 4.0 to 6.0 months typically indicates a “balanced market,” where neither buyers nor sellers have an advantage.

Single-Family Homes Update:

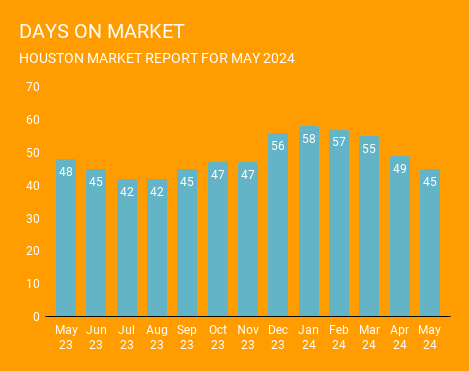

Single-family homes saw a marginal decline in sales but an increase in pricing. Days on Market decreased from 49 to 45 days, indicating a faster selling pace. Like the market as a whole, single-family home inventory expanded significantly, reflecting a more balanced market conducive to both buying and selling.

Townhouse/Condominium Trends:

Townhomes and condominiums experienced a surge in inventory, reaching the highest levels in nearly 12 years. Despite a 9.8% drop in sales, the average and median prices rose sharply, hitting record highs and indicating sustained interest in these property types.

May Monthly Market Insights:

Despite initial challenges, May showcased a resilient market with expanding inventory and strong buyer demand, which contributed to record-breaking home prices across Greater Houston. Active listings surged 38.2% from last year, and while total property sales declined by 3.1%, the total dollar volume remained stable at $4.3 billion.

Looking Ahead:

The Houston real estate market continues to adapt and thrive, even amidst external challenges. With increased inventory and steady demand, the market is poised for continued activity, offering opportunities for both buyers and sellers. We typically see some decline in activity as we reach late July and August. However, if mortgage rates continue to decline, we could see the buyer demand sustain through the rest of the year.

Remember that every market is unique in Houston. Your home or the home you are looking to buy, may be dealing with different marketing dynamics than the ones affecting the entire Houston market. Engaging with an experienced Realtor, like the ones found at Norhill Realty, can provide critical guidance and insights, whether you are buying or selling in this unique Houston market.

For a comprehensive overview and expert advice, consider connecting with Norhill Realty to navigate these trends effectively. Fill out the form to get started.

GET MATCHED WITH AN AGENT