Amid rising mortgage rates, the Houston housing market remained robust in November, with continued growth in home sales and an expanding inventory. Home sellers will be pleased to see higher prices in most neighborhoods and home buyers will welcome the increased number of options to choose from.

Key Highlights from the Houston Association of Realtors (HAR) November 2024 Market Update:

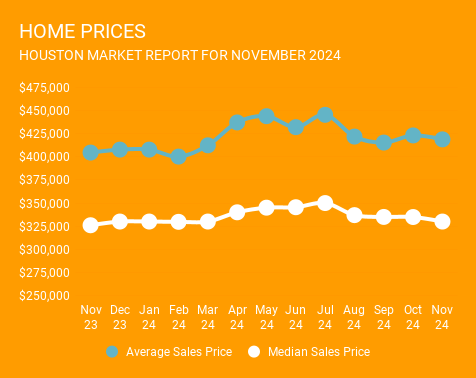

Home Prices: The average home price increased by 4.1% to $418,903, and the median price edged up by 1.5% to $329,900.

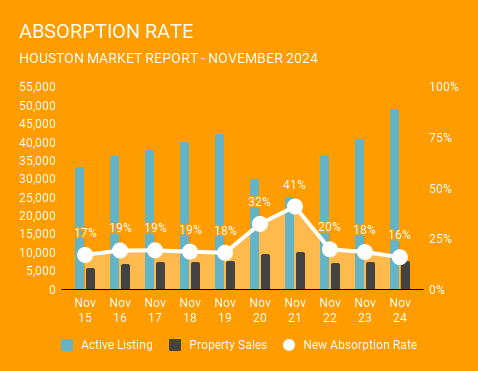

Likely to Sale: According to HAR, total active listings, or the total number of available properties, increased 12.6 percent to 45,714. December sales of all property types totaled 8,478 up 13.6 percent compared to December 2023.

As a result, the absorption rate, which is a measure of any given home’s likelihood to sell, for December 2024 was 16 percent. This remains relatively unchanged from this time last year and last month. We have a few more homes on the market, but homes sales overall are up.

Sales Overview: Single-family home sales in the Greater Houston area saw a 6.0% increase year-over-year, with 6,559 units sold compared to 6,187 in November 2023.

Market Segments: The luxury segment ($1 million+) led the market with a 21.4% increase in sales. This was closely followed by the homes priced below $99,999, which saw a 21.3% rise. The segment priced between $100,000 and $149,999 experienced a decline of 8.3%.

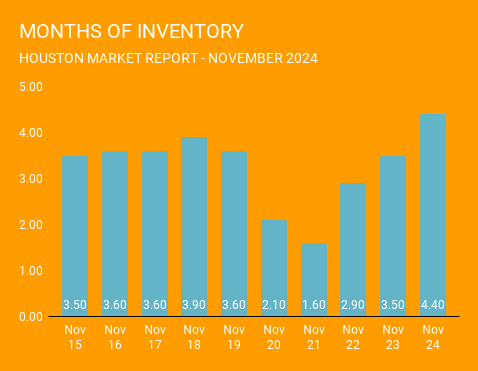

Inventory: Inventory levels expanded from a 3.5-months supply last November to 4.4 months, which has held steady since August. Housing inventory nationally stands at a 4.2-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply is generally considered a “balanced market” in which neither buyer nor seller has an advantage.

Days on Market:

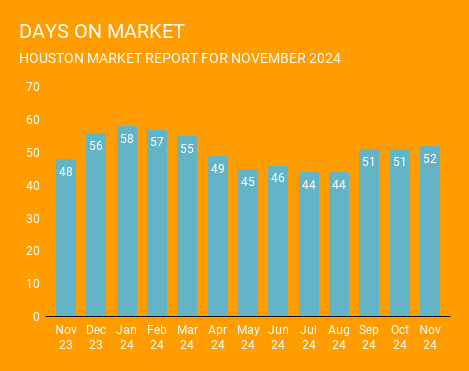

At 52 days, the days on market has remained pretty stable over the past 3 months.

November Monthly Market Insights:

The market demonstrated significant resilience, with sales and total dollar volume rising, despite the higher mortgage rates that typically slow market activity. Active listings were 22.1% above the levels seen in November 2023, indicating a healthy expansion of available properties.

Single-Family Homes Update:

Single-family homes continued to perform well with consistent sales growth over the past three months. While the average price per square foot saw a modest increase, days on market also rose, suggesting a slight slowdown in the pace of sales.

Townhouse/Condominium Trends:

Townhomes and condominiums experienced a downturn in November, with sales decreasing by 12.0% year-over-year. Despite this, the average and median prices in this segment faced significant reductions, possibly reflecting changes in buyer preferences or market dynamics.

Looking Ahead:

Houston’s housing market is navigating through the challenges posed by external economic factors, such as inflation and interest rates, with a strong performance in the luxury and lower-end market segments. As inventory levels continue to rise, the market is adapting to meet the needs of a diverse range of buyers.

To receive more market updates like this one on a monthly basis, fill out the form below.

SIGN UP FOR OUR MONTHLY NEWSLETTER