This year, many Houstonians are facing a significant decision: is it better to buy a home or continue renting? With the real estate landscape continuously evolving, especially in a bustling metropolitan area like Houston, this choice has become more complex than ever. This article will delve into the factors that prospective homeowners and renters should consider, helping you make an informed decision that aligns with your financial and lifestyle goals.

The Houston Housing Market

Before diving into whether to buy or rent, it’s crucial to understand the current state of Houston’s housing market. Houston has historically been known for its affordable housing compared to other major U.S. cities, but prices have been rising. The influx of new jobs, coupled with Houston’s no-zoning laws, creates a dynamic real estate environment that could influence your decision to buy or rent. Stay up on the Houston market by signing up for our Monthly Market Updates.

Advantages of Buying a Home in Houston

1. Long-Term Financial Investment Owning a home is traditionally seen as a good long-term investment. Despite market fluctuations, the overall trend in real estate values tends to go upward over time. For those planning to stay in Houston long-term, buying a home could mean benefiting from appreciation in property value.

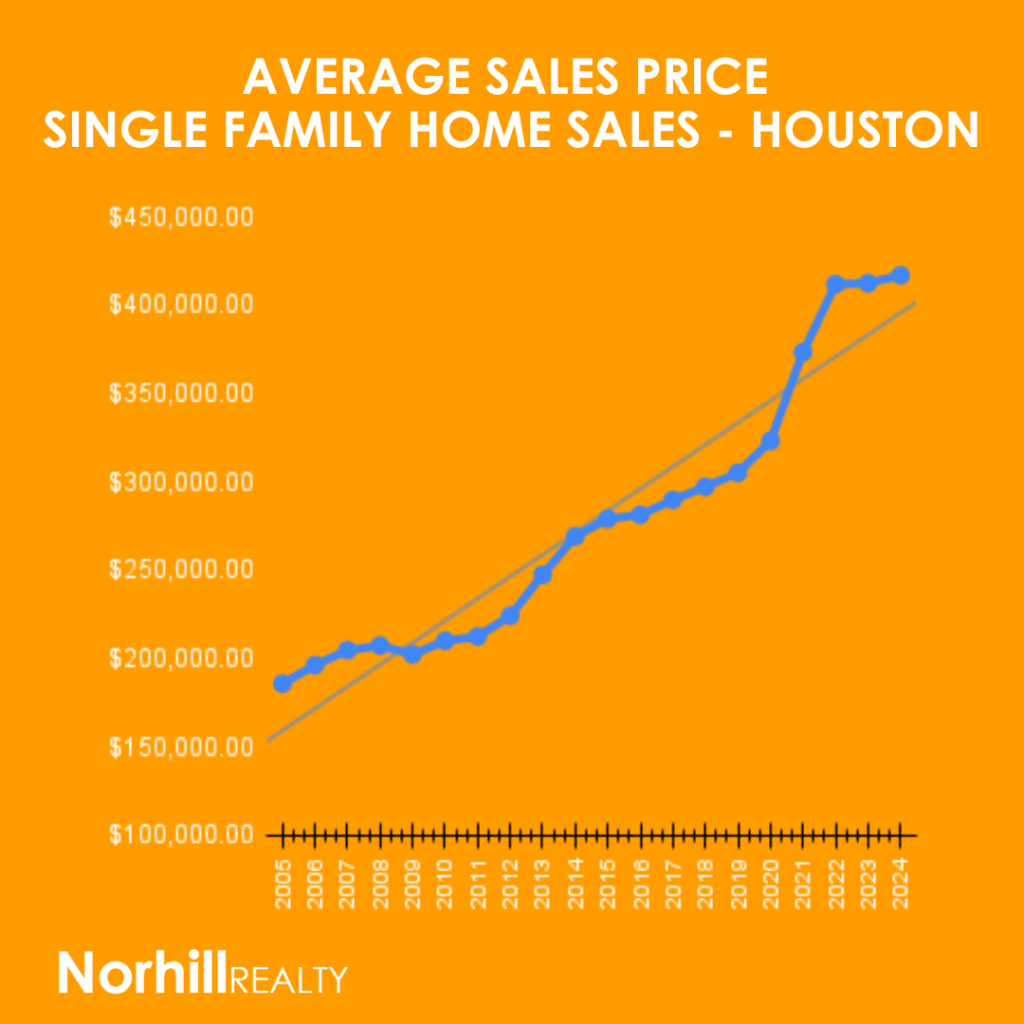

As seen in the chart below, Houston home prices have been steadily increasing over the past 20 years. Over that time, the average home prices has risen from $185,907.00 to $416,765.00 for a 124.1% increase. Prices have also averaged 4.42% annual growth during that period.

2. Stability and Predictability Unlike renting, where rent prices can fluctuate with market changes, buying a home with a fixed-rate mortgage stabilizes your monthly payments. This predictability allows for better financial planning and security.

3. Personalization and Freedom Homeownership offers the freedom to modify and customize your living space to suit your tastes and needs without the restrictions often imposed by rental agreements.

4. Tax Benefits Most homeowners can take take advantage of significant tax deductions, particularly on mortgage interest, which can provide substantial financial relief. Ask your Accountant for more details.

Advantages of Renting in Houston

1. Flexibility Renting offers unparalleled flexibility compared to owning a home. Lease terms are typically no longer than a year, which is advantageous for those who might face job changes, relocation, or simply desire a change in scenery.

2. Lower Initial Costs The upfront costs of renting—typically a security deposit and the first month’s rent—are considerably lower than the down payment and closing costs required to buy a home.

3. No Maintenance Hassles One of the significant perks of renting is that maintenance responsibilities fall to the landlord, not the tenant. This can save renters substantial amounts of money and time.

4. Access to Amenities Many rental properties, specifically apartments, offer amenities that might be cost-prohibitive for average homeowners, such as fitness centers, swimming pools, and community spaces.

Key Factors to Consider

1. Financial Readiness Assess your financial situation before deciding. Buying a home is a substantial financial commitment that requires readiness for upfront and ongoing costs.

2. Market Timing Real estate markets fluctuate, and so do rental markets. A Realtor can help you analyze the current trends in Houston’s real estate market, including interest rates and housing prices, to choose a good time to buy or rent.

3. Lifestyle Needs Consider your lifestyle preferences and needs. Do you need stability and a place to call your own, or do you prefer the flexibility that renting allows?

4. Future Goals Align this decision with your long-term personal and financial goals. If you’re setting roots or planning for a family, buying might make more sense. If you’re uncertain about your future or career, renting might be the better choice.

The decision to buy or rent a home in Houston in 2024 hinges on a mixture of personal, financial, and lifestyle factors. While buying a home can offer long-term financial benefits and stability, renting provides flexibility and freedom from maintenance hassles.

For those leaning towards purchasing a home, consider the current market conditions, your financial stability, and readiness for homeownership. For those who prefer to rent, enjoy the flexibility and simplicity it offers, especially if you anticipate significant life changes.

At Norhill Realty, we understand that whether to buy or rent is a personal decision that requires thoughtful consideration. There is no one size fits all with real estate. Our team is here to provide insights and assistance tailored to your specific needs and circumstances.

Contact us today to get matched with an agent so they can help you make the best possible decision for your living situation in Houston.

Fill out the form below to connect with a Realtor.

GET MATCHED WITH AN AGENT