For an over Norhill Realty’s real estate forecast for 2023, click here.

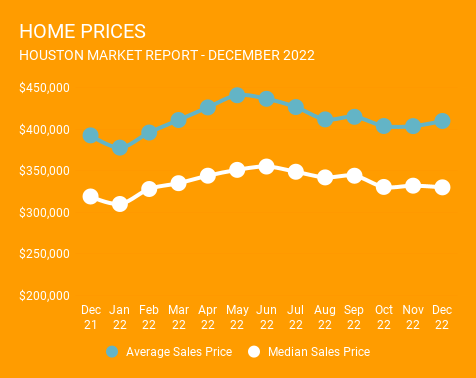

To close the year, the Houston real estate market continued its progress into a much more normal balance. Since the beginning of the pandemic in the Spring of 2020, the real estate market across the region has experienced low inventory levels and double-digit price growth. Although inventory levels still remain historically low, prices have begun to flatten out. That being said, prices could start to tick up again this Spring if mortgage rates continue to fall as they have done in recent weeks. Stay tuned for more on that possibility.

According to the latest report from the Houston Association of Realtors (HAR), 7,634 units were sold in December compared to 11,656 in December 2021. On an annual basis, we saw a 10.7 percent decline compared to 2022’s record setting year.

Despite falling sales activity, home prices are still up year-over-year. In 2023, the average price rose 10.0 percent to $413,657 while the median price increased 12.8 percent to $338,295. That marks the 2nd consecutive year of double digit price growth and Houston home prices have grown every year since 2010.

According to HAR, total active listings, or the total number of available properties, increased 55.2 percent to 33,776. December sales of all property types totaled 7,634, down 34.5 percent compared to December 2021. As a result, the absorption rate for December 2022 was 23 percent. Although still very strong by historic standards, this is down considerably from the high absorption we have seen over the past 2 years. However, Homes were still more likely to move than back in November when the absorption rate was 20 percent.

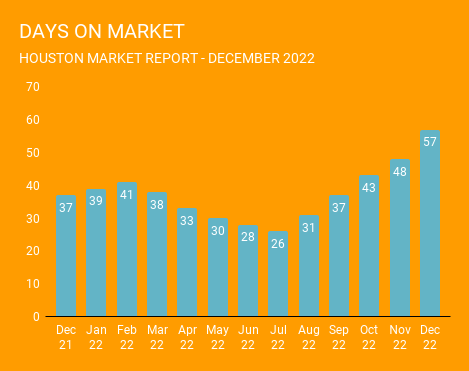

The Days on Market (DOM), or the number of days it took the average home to sell, rose to 57 days in December, up from the 37 days on market we saw last December.

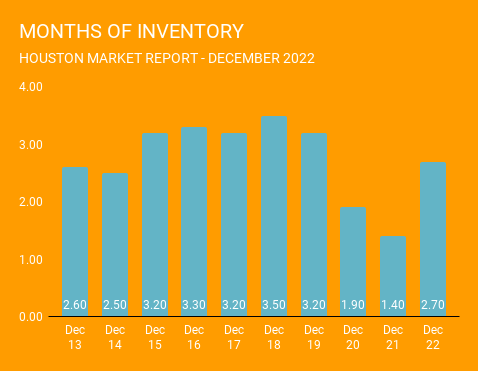

Inventory levels fell from the 2.9 months of supply we saw in November. However, they are up considerably compared to 2021. At the end of December, we had a 2.7-months supply of available homes. In December 2021, we only had 1. 4 months. Housing inventory nationally stands at a 3.3 months supply, according to the latest report from the National Association of Realtors (NAR).

A 6.0-month supply is generally considered a “balanced market”. By historic standards, we are still in a Seller’s market, but buyers are definitely finding a few more options than at any time over the past 2 years.

As predicted in our 2023 Houston Real Estate Outlook, we are seeing a little spike in demand now that the new year has begun. This has been driven by falling mortgage rates and the strength of the Houston economy. If mortgage rates continue to fall, even modestly, over the coming months and the Houston economy remains resilient, we are probably looking at a fairly strong 2nd Quarter and higher prices. If you have been thinking of selling in 2023, spring might be a good opportunity for you to sell. If you are a buyer, you may want to move up your timeline in February or March so you can get in before prices start to rise.

Regardless talk to a professional so you can get advice to determine if this year is the right time for you. Contacting a Norhill Realtor is a good place to start. Get connected with one of our experienced agents who can talk you through the market in the neighborhoods you care about as well as discuss the timing for either selling or buying.